(Bloomberg) — London’s lament over a shrinking equity market has been drowned out — for the moment at least — by the stellar trading debut of personal computer maker Raspberry Pi.

Most Read from Bloomberg

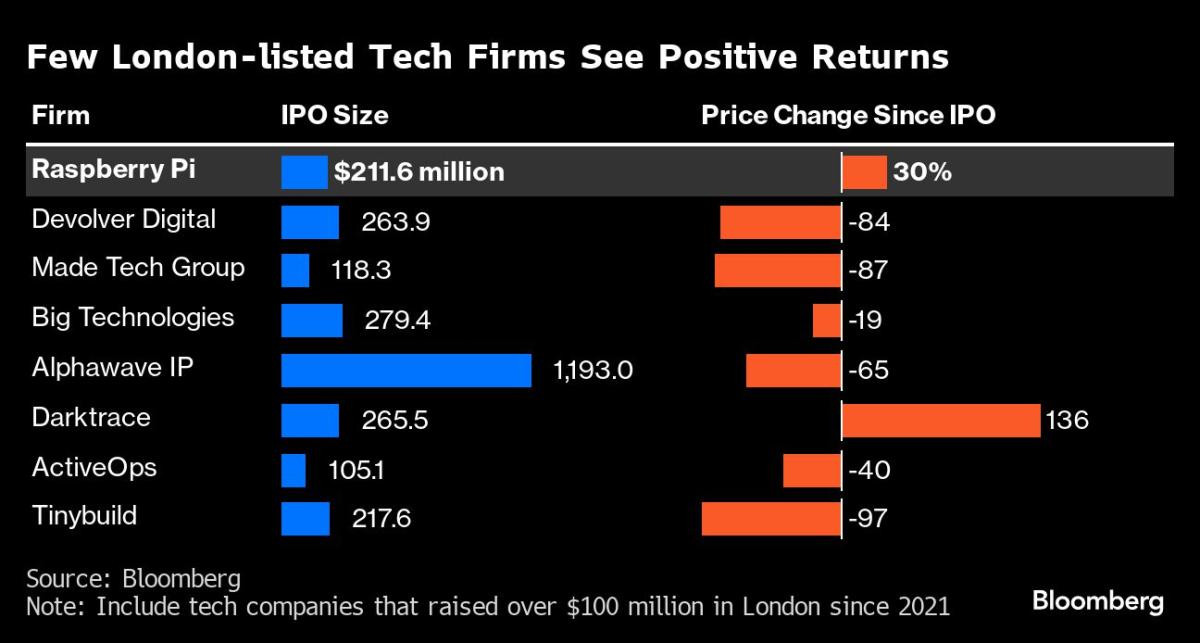

Shares in the British creator of low-cost computers popular among hobbyists and educators soared by as much as 43% Tuesday after a £166 million ($211 million) initial public offering. It’s on track to be the strongest first-day performance in about three years for a company raising at least $100 million in a London listing, according to data compiled by Bloomberg.

The pleasing start for Cambridge, England-based Raspberry Pi brings relief to a market struggling to stop local firms from chasing richer valuations abroad. Activists and foreign suitors alike are trying to lure companies stateside, citing deeper markets in New York, where investors have an established and strong appetite for tech names.

In a painful snub for London, home-grown Arm Holdings Plc, whose chips are used in Raspberry Pi’s products, opted to go public in the US last year. Arm’s investment division took up shares in the listing of Raspberry Pi, founded about 16 years ago.

Investors, meanwhile, are entitled to be wary of new UK listings. CAB Payments Holdings Plc, the last meaningful debut in London has tumbled 62% since its IPO last June.

Some are hopeful that today’s positive performance is early evidence of a turnaround.

“It shows the UK is open for business to technology flotations and that investors are hungry for companies of any size if they tick the right boxes,” Dan Coatsworth, investment analyst at AJ Bell, said in emailed comments. “There is a widely held view that tech companies only float in the US where they can potentially get a higher valuation. Raspberry Pi is proof that the UK can still compete against the likes of the Nasdaq and attract home-grown champions.”

Any news on the London listings front is attracting out-sized attention from banks and the UK government alike, after the City’s share of the broader European IPO market plunged to the lowest level in decades.

Walgreens Boots Alliance Inc. has shelved plans for a potential first-time share sale of its British drugstore chain Boots, dashing hopes for a blockbuster London listing, Bloomberg News reported last week.

More optimistically, online fashion retailer Shein is planning a mega London listing with an estimated valuation of £50 billion, which would be big enough to soothe worries over the UK IPO market for a while.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.