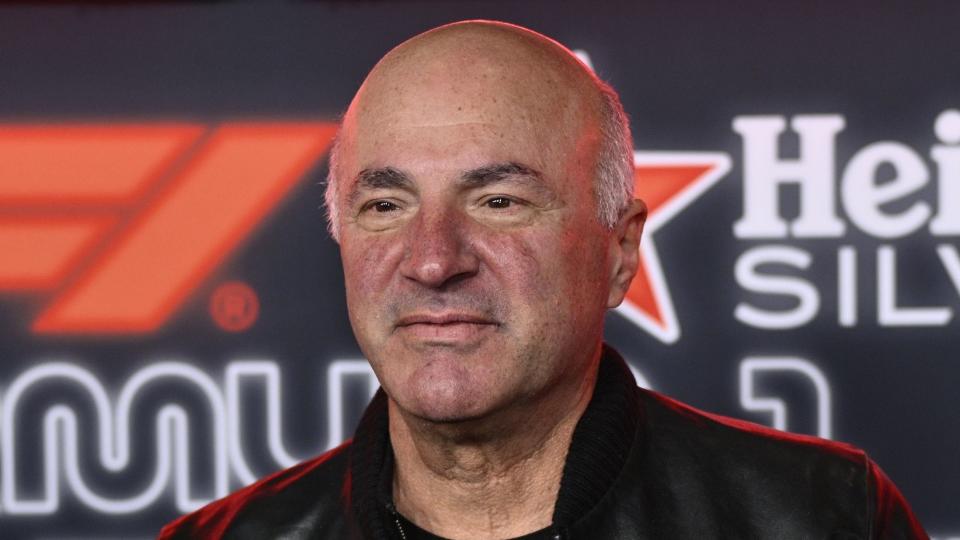

Entrepreneur, Shark Tank host, and investor Kevin O’Leary-also known as “Mr. Wonderful,” has been giving financial advice for several years.

Explore: 30 Celebrities Who Went From Rags to Riches

Also: 4 Genius Things All Wealthy People Do With Their Money

O’Leary — whose net worth stands at $400 million, according to Entrepreneur — is also a host on the show “Shark Tank,” which has been running since 2009. In turn, he has been helping newbie entrepreneurs launch their business ideas.

“These entrepreneurs are no longer just investments — they become part of the family,” according to O’Leary’s website.

Wealthy people know the best money secrets. Learn how to copy them.

Separate Your Emotions from Your Financial Decisions

And now, some of O’Leary’s admirers are sharing which pieces of advice they abide by and what has helped them in their own financial journey.

Anna Skaya, the founder of Basepaws, a company that “offers DNA testing services for pets to provide insights into their breed, health, and genetic traits,” has experienced O’Leary’s wisdom firsthand.

More Shark Tank Advice: Barbara Corcoran’s 5 Best Passive Income Ideas

Indeed, she first met him when Basepaws was featured on Shark Tank in 2019, and O’Leary ended up investing $125,000 in the company, she said.

One thing she admires most about him is his rule of keeping emotions separate from financial decisions.

“He didn’t love the Basepaws business when he first met me on Shark Tank — though,” said Skaya. “In his own words, it was a ‘crazy’ idea — but we had strong numbers, fast growth, and a solid founder track record. He invested and we are one of the highest IRR [internal rate of return] deals in all of Shark Tank. Kevin’s personality and emotions are fun for TV, but he invests with a clear, strategic mindset.”

Animal health company Zoetis acquired Basepaws in 2022, according to an announcement. According to Business Insider, the deal was valued at $93 million.

What’s more, of all of his Shark Tank investments, O’Leary said that Basepaws was “his biggest winner in percentage terms, “according to Business Insider.

Pay Off Debt

Dr. Peter C. Earle, senior economist at the American Institute for Economic Research, and a regular viewer of Shark Tank, said that one of his favorite pieces of advice is that Mr. Wonderful stresses the importance of paying off debt.

“One of the points that O’Leary has hammered home over the years is to pay off debt before making serious or sizable investments,” he said.

According to Earle, lower financial stress, reduced uncertainty, higher/better credit scores, and establishing a solid foundation for assessing the performance of investments without the cloud of debt overhang is advice one doesn’t often receive, unfortunately.

Debt as a Strategic Tool

Noah Lydiard, CEO and founder of Conductor, said that O’Leary’s rules, notably those about managing debt, have struck a chord with him.

“He often says, ‘debt can be a powerful tool, but it can also be a dangerous weapon.’ This really resonates with me, especially in the creative industry where projects often require significant upfront investment,” said Lydiard. “Understanding how to leverage debt responsibly has been crucial in growing my businesses while managing financial risks.”

Investing in Yourself

Another principle of O’Leary’s Lydiard has found essential is the idea of investing in yourself.

“Whether it’s acquiring new skills or expanding your knowledge base, O’Leary emphasizes that these investments can significantly boost your earning potential,” he said. “In the world of filmmaking and creative production, staying ahead means constantly learning and adapting to new technologies and trends.”

He added that this mindset has been instrumental in navigating the competitive landscape of his industry.

Diversification

Diversification is another key rule of O’Leary’s that Lydiard said he abides by.

“Beyond just spreading investments across different asset classes, diversification of income streams is critical in a field as volatile as entertainment,” he said. “Projects can be unpredictable, so having multiple revenue sources helps to stabilize cash flow and mitigate risks.”

Finally, according to him, O’Leary’s money rules aren’t just theoretical principles — they’re practical guidelines that have shaped his financial decisions and strategies.

“As I continue to grow Conductor and expand Rumble Riot Films, I remain committed to these principles that emphasize prudence, foresight, and adaptability in managing finances and pursuing entrepreneurial ventures,” he added.

Getting Down to Numbers That Matter

Erik Severinghaus, founder and CEO of Bloomfilter, said that one thing he has learned from O’Leary is the importance of understanding your numbers well.

“It’s not just about what you earn — it’s also crucial to see where each dollar goes,” he said. “This knowledge helps me very much to make better money choices in BloomFilter and for my own budget. I began to write down my expenses and discovered many ways to spend less money.”

Mastering Negotiations

Negotiation skills are another thing Severinghaus said he learned from O’Leary.

“When I talk about contracts or looking for a good price on office supplies, using the same negotiation methods as O’Leary’s helps Bloomfilter save a lot of money and make our profits higher,” he added.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: I’m a ‘Shark Tank’ Fanatic: 7 Ways Kevin O’Leary’s Money Wisdom Helped My Finances