The U.S. government has focused significantly on the country’s position in the semiconductor market, and that’s not surprising — chips play a critical role in multiple industries, ranging from automotive to smartphones, computers, and artificial intelligence (AI).

A key effort: the CHIPS and Science Act, which was enacted in 2022, has accelerated investments in the U.S. semiconductor industry. As a part of this program, the U.S. government has awarded nearly $30 billion in grants and $25 billion in loans to seven companies. Thanks to these massive investments, semiconductor manufacturing capacity in the U.S. is set to triple by 2032, growing an estimated 203% in less than a decade, according to a report by the Semiconductor Industry Association and Boston Consulting Group.

Let’s take a closer look at two semiconductor companies that are beneficiaries of the CHIPS Act. Both have already received assistance from the U.S. government, are growing at a terrific rate, and could deliver huge upside by 2032 that could match the jump in U.S. semiconductor spending.

1. Micron Technology

On April 25, Micron Technology (NASDAQ: MU) reached preliminary terms with the U.S. government for a proposed funding of $6.1 billion under the CHIPS Act, along with proposed loans of up to $7.5 billion. The memory specialist says that this grant will support its capex plans worth $50 billion to build advanced chips in the U.S. through 2030.

This improved production capacity will give Micron’s growth a big boost in the long run, allowing it to win a bigger share of the market it operates in. Micron was the third-largest supplier of dynamic random access memory chips (DRAM) last year, with a share of 23%.

It is worth noting that Micron is witnessing robust demand for its DRAM chips thanks to AI. For instance, on the March earnings conference call, management remarked that Micron has sold out its high-bandwidth memory (HBM) capacity for 2024. Micron also added that “the overwhelming majority of our 2025 supply has already been allocated.”

That’s not surprising — the demand for HBM is expected to triple this year because of its deployment in AI chips from the likes of Nvidia and others. HBM demand is expected to double once again next year and could clock annual growth of 68% through 2030. Meanwhile, the overall memory market is expected to generate $338 billion in annual revenue in 2032, compared to $134 billion in 2023, according to Credence Research.

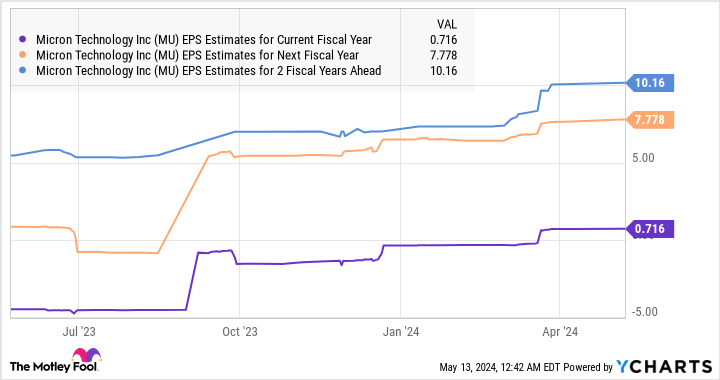

So, Micron’s higher production capacity, thanks to the favorable conditions in the U.S. semiconductor industry, should pave the way for long-term growth. The good part is that Micron is already growing quickly thanks to outstanding end-market demand. As the following chart indicates, its earnings are expected to take off following a loss of $4.45 per share in the previous fiscal year.

Assuming Micron does hit $10.16 per share in earnings in a couple of fiscal years and trades at 30 times earnings, in line with the Nasdaq-100‘s earnings multiple (using the index as a proxy for tech stocks), its share price could increase to $305 per share. That would be 2.5 times its current stock price. Moreover, the secular growth opportunity in the memory market and the company’s focus on enhancing its capacity could help it deliver more upside in the future, and the stock may even triple in the long run.

With Micron currently trading at 17 times forward earnings, investors are getting a good deal on this semiconductor stock right now, and they should consider taking advantage of its cheap valuation. It seems built for impressive long-term growth.

2. Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing Company (NYSE: TSM), popularly known as TSMC, is another beneficiary of the CHIPS Act. Last month, the U.S. Department of Commerce proposed $6.6 billion in direct funding and another $5 billion in proposed loans to the foundry giant to support its expansion in the U.S. The company has already completed its first fabrication facility in the U.S. and is currently constructing another one. And now, TSMC will add a third fabrication plant in Arizona.

This new plant will bring TSMC’s total investment in U.S. semiconductor manufacturing in Arizona to $65 billion. TSMC says that it has decided to build a third plant to “meet strong customer demand leveraging the most advanced semiconductor process technology in the United States.” TSMC management said on the April earnings conference call that it plans to spend 70% to 80% of its $28 billion to $32 billion capital budget for 2024 on advanced process technologies.

These advanced processes refer to chips manufactured on nodes that are 7 nanometers (nm) or smaller, and their demand has increased substantially over the past year thanks to AI. TSMC’s customers, such as Nvidia, AMD, Intel, and Apple, are using process nodes that are 5 nm or smaller in their AI chips and AI-focused products such as MacBooks.

Moreover, this strong customer base has made TSMC the world’s leading foundry with a market share of 61%, according to Counterpoint Research. This puts the company way ahead of Samsung, the second-largest foundry in the world with a share of 14%. This dominant market share means that TSMC is in a solid position to capitalize on the overall growth of the semiconductor market.

Precedence Research forecasts that the semiconductor market could be worth an estimated $1.9 trillion in 2032, compared to $664 billion last year. In simple words, the global semiconductor market could triple in less than a decade, and TSMC may witness solid growth in its business by expanding its manufacturing capacity and capturing a bigger share of the same.

Analysts expect TSMC’s earnings to increase at an annual rate of 21% for the next five years. Assuming it can maintain even a 15% annual earnings growth for the next decade, its bottom line could jump to $25 per share. TSMC has a five-year average earnings multiple of 21, and a similar multiple after a decade (hypothetically — all else equal) could send its stock price to $525 based on the earnings projected above.

That would be more than three times its current stock price, suggesting that investors looking to take advantage of the revolution in the U.S. semiconductor industry would do well to buy TSMC stock for the long run.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $553,880!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

U.S. Chip Manufacturing Could Triple in Less Than a Decade: 2 Stocks That Could Follow Suit was originally published by The Motley Fool