The Bank of England governor has sounded a relatively optimistic note on the economy, predicting that the coronavirus shock would cause less long-term damage than most recessions.

Andrew Bailey also told a Resolution Foundation event that he expected to cut the Bank’s unemployment forecast following last week’s budget and that the Bank’s forecasts suggested the COVID-19 pandemic and lockdown could leave a 1.75% dent in Britain’s permanent output level – lower than some forecasters and smaller than the 3% hit expected by the Office for Budget Responsibility.

In a speech, the governor said: “I see reasons to believe that the longer-term negative economic effects of the COVID shock will be smaller than we have seen in the past, particularly in the 1980s and early 1990s.”

However Mr Bailey added that arguably a deeper concern was two trends which pre-dated COVID: “First, the UK has experienced a fall in the average rate of growth, reflecting slower growth in potential supply capacity… It is apparent that the average growth rate has fallen from around 2.5% in the years before the global financial crisis, to around 1.5% in the period immediately prior to the COVID pandemic.”

He added that labour productivity had also fallen significantly over the past two decades, saying: “The level of activity in the UK following the global financial crisis is significantly below its level at the equivalent stage following the 1930s Depression.”

Mr Bailey’s comments are significant because there is much debate among economists about the likely permanent damage from the pandemic, as people shift their working patterns and, potentially, some industries such as public transport and office space may face a permanent decline.

While the Bank is somewhat more optimistic about the impact than the OBR, it is more pessimistic than some economists.

Mr Bailey said: “There are reasons to believe that so-called longer-term scarring damage to the economy will be more limited than in some past recessions, but there will most likely be structural change which will influence the future of supply and demand.”

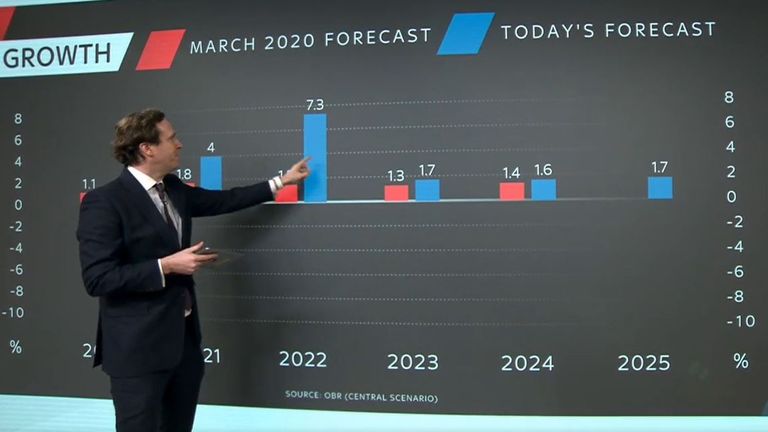

It follows last week’s budget, in which the chancellor announced extensions to many of the COVID support schemes, which represent a major fiscal boost for the next two years.

However, the budget also included significant tax rises in the following three years, especially through corporation tax and, to a lesser extent, via direct household taxes.

The governor added that he expected, as a result, to upgrade the Bank’s labour market projection next time it produces its forecasts in May, saying: “I would expect that we would have a lower profile on unemployment.”