The Bank of England has predicted a slightly quicker bounce-back for consumer spending this spring than previously thought as lockdowns are eased.

Minutes of the Bank’s latest monetary policy meeting showed rate-setting officials also think that the short-term rise in unemployment will be “more moderate” than it expected just a month ago.

The Bank said plans for the easing of lockdowns suggested restrictions being lifted “somewhat more rapidly” than had been assumed in its February report on the UK economy.

It said that “may be consistent with a slightly stronger outlook for consumption growth” in the April-June period than it anticipated at the time.

The latest comments came as officials unanimously agreed to leave interest rates on hold at 0.1% and left unchanged its £895bn programme of asset purchases known as quantitative easing.

They come after Bank governor Andrew Bailey recently sounded a relatively optimistic note on the economy, predicting that the coronavirus shock would cause less long-term damage than most recessions.

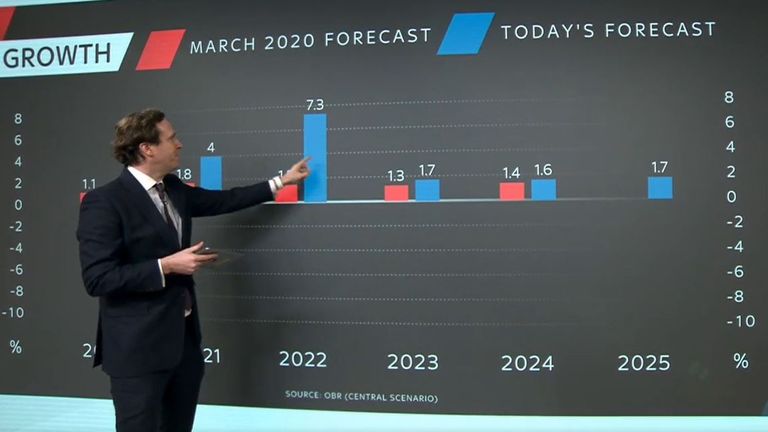

Policy makers had already in February pencilled in a rapid recovery for GDP as vaccines are rolled out, some of it fuelled by a huge build up in household savings, with an estimated extra £125bn stashed away between March and November last year.

The Bank said then that it expected GDP to grow by 5% in 2021 and the rate-setters’ latest comments, while more positive about the short-term. suggested it was “less clear” there would be any boost to this medium-term outlook.

But they do seem to expect now that the rise in joblessness would be less severe than had been feared.

The Bank had predicted in February that this would peak at 7.75% this year – but that was before the latest extension of the government’s furlough scheme subsidising wages for workers temporarily laid off as a result of the pandemic.

It now expects the near-term rise in unemployment to be “more moderate than suggested by the MPC’s [monetary policy committee] February projections”.

The Bank also said world economic developments had been a little stronger than anticipated and were likely to be boosted further by US president Joe Biden’s $1.9trn stimulus package.

There was a note of caution that the outlook for the UK remained “unusually uncertain”.

“It continues to depend on the evolution of the pandemic, measures taken to protect public health, and how households, businesses and financial markets respond to these developments,” the MPC said.

The Bank still sees inflation, which stood at 0.7% at the start of the year, returning quickly to its 2% target in the spring but thinks that can largely be explained by comparisons with last year’s oil price slump.

Laith Khalaf, financial analyst at AJ Bell, said: “The Bank of England provided a pretty bullish assessment of the prospects for economic recovery in its February monetary report and since then the outlook has got even better.

“Further support from the Chancellor in the Budget, a roadmap out of lockdown and fiscal stimulus spilling over from the US, all support the case for a robust bounceback, as the UK economy opens up in the coming months.

“But the message coming through from the Bank of England is that interest rates are going to remain nailed to the floor for the foreseeable future, despite the improving economic picture.

“The only thing that might prise rates upwards is a bout of inflation, but that would need to be both sustained and structural to compel the Bank of England to tighten policy.”