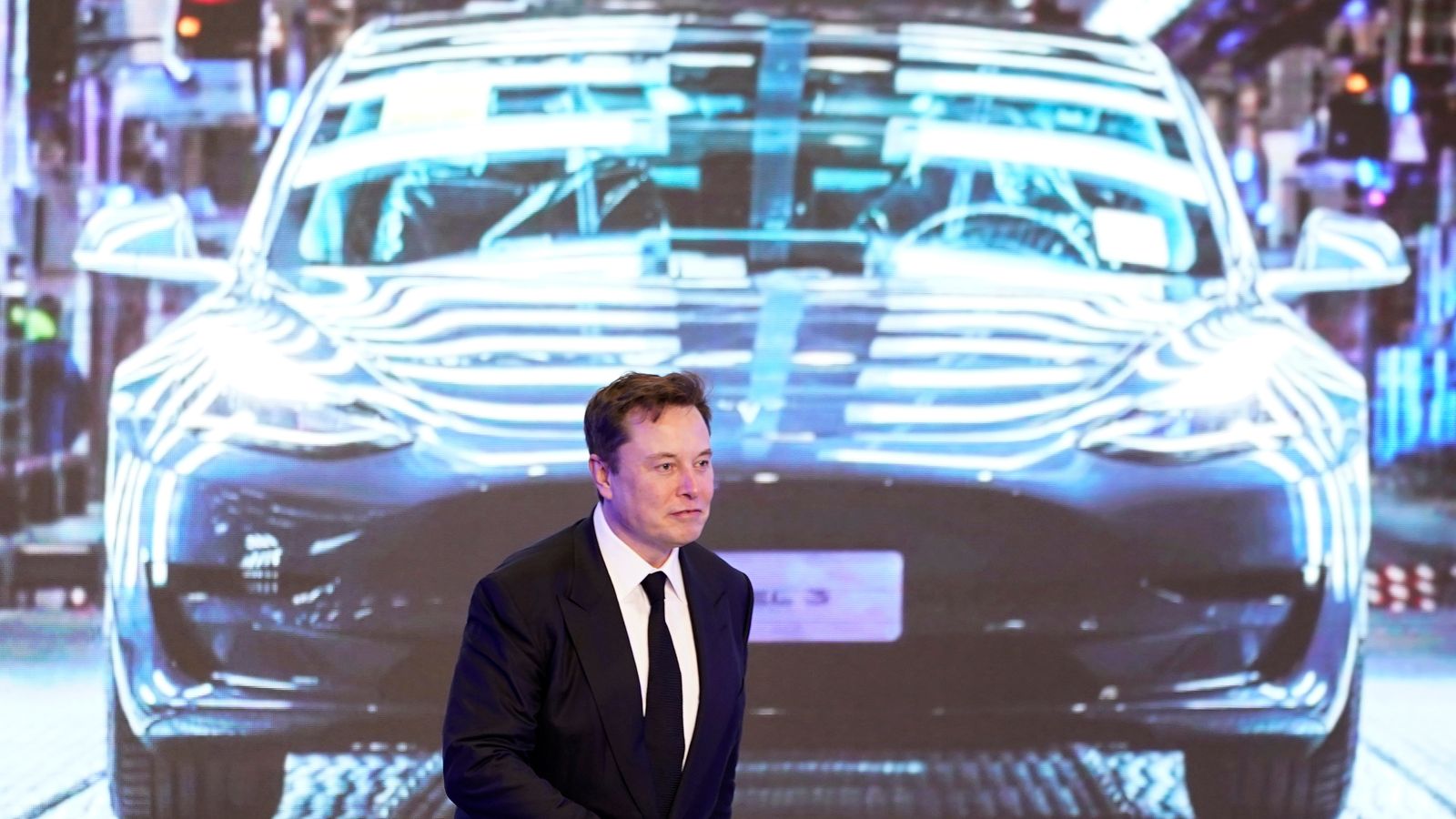

Elon Musk is eligible for two options payouts worth a combined $11bn (£7.9bn) after Tesla hit quarterly performance targets.

The electric carmaker posted a record number of deliveries during the three-month period ending 31 March, despite a global shortage of chips that restricted rivals.

Mr Musk said the period saw “some of the most difficult supply chain challenges that we’ve ever experienced at Tesla”.

Tesla made $438m (£315m) in the first quarter, with nearly 185,000 vehicles sold – almost twice the number sold at the same time last year.

The company said it expected this year’s volume growth to exceed 50%, and it is on track to start production and deliveries at its factories in Texas and Berlin.

Deliveries of the new Model S should start soon and the Model Y production rate in Shanghai is improving.

Peter Hanks of DailyFX.com added: “Tesla looks well positioned to continue delivering more vehicles in the future as more production plants come online which, in turn, could see the company reign in the ludicrous valuation metrics that it currently possesses.”

Tesla’s first-quarter revenue of $10.39bn (£7.5bn) was up from $5.99bn (£4.3bn) at the same time last year but net profit was hit by a $299m (£215m) award to Mr Musk.

Roth Capital Partners analyst Craig Irwin said: “Higher regulatory credits, lower taxes, and bitcoin sales buoyed financial results. Back these out, and it was a large miss.”

Questions have been raised about the way Telsa achieves profitability, as a major portion of it comes from selling regulatory credits to other carmakers.

Tesla earns regulatory credits from governments around the world for manufacturing zero-emissions vehicles and sells these to other car manufacturers that produce vehicles that run on petrol and diesel.

Without $518m (£372m) in credits for the quarter, Tesla would have lost money.

Tesla cut its bitcoin position by 10% during the quarter, with Chief Financial Officer Zachary Kirkhorn saying: “We do believe long term in the value of bitcoin.

“It is our intent to hold what we have long term and continue to accumulate bitcoin from transactions from our customers as they purchase vehicles.”

Mr Musk said on Twitter that he had not sold any of his personal bitcoins.

Meanwhile, Tesla’s self-driving software is being looked at by US federal investigators after 28 crashes in the country.