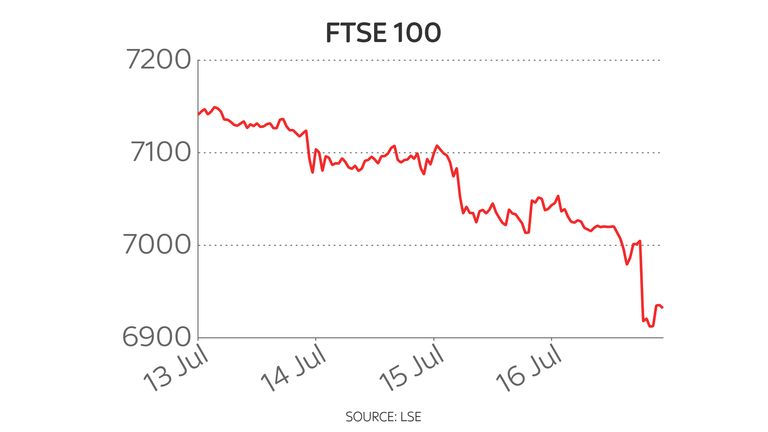

The FTSE 100 and the pound have fallen as Britain’s “freedom day” failed to assuage growing fears about COVID case numbers and disruption.

London’s leading share index was just over 100 points, or 1.4%, lower in early trading – taking it below the 7,000-mark – led by a 5% fall for British Airways owner International Airlines Group (IAG).

Aircraft engine maker Rolls-Royce, Holiday Inn to Crowne Plaza owner Intercontinental Hotels Group and Whitbread, owner of Premier Inn, were also among the worst hit.

There were no stocks in the risers’ column as the FTSE joined in a global sell-off which saw similar declines on European bourses and followed falls overnight in Asia.

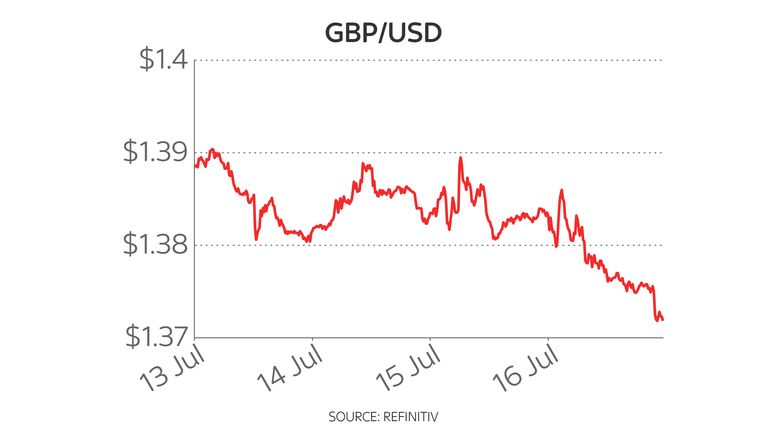

Meanwhile the pound dipped by more than half a cent against the US dollar to just over $1.37, its lowest level in three months.

Analysts have pointed to rising cases globally as well as increasing fears about growing inflation as being behind the latest cautious turn for investors.

Richard Hunter, head of markets at interactive investor, said: “The general breadth of economic concerns has inevitably spread to the UK market, with the likes of the oil and mining sectors under pressure within the premier index on fears of slowing growth.

“At the same time, stocks caught in the reopening trade such as the travel sector continue to be volatile even after the easing of some international restrictions, as time begins to run down on a potential 2021 return to widespread tourism.”

In the UK, hopes for another leap back to normality for the economy as social distancing and mask wearing rules are abolished have been undercut by a resurgence in cases and warnings to the public to remain cautious.

Meanwhile, businesses are increasingly feeling the impact of large numbers of workers being absent because they are forced to self isolate after being alerted by the COVID-19 app.

In the travel sector, fading hopes for holiday sales were dealt a further blow over the weekend as Britons returning from France were told they will still have to quarantine even if they are fully vaccinated.

Michael Hewson, market analyst at CMC Markets, said: “There was a great deal of optimism over the summer reopening, but as we look at how Delta variant infections are rising, some of that optimism is dissipating.”

Britain’s currency is in focus as investors watch for the outcome of restrictions being eased even as cases are soaring.

“The world will be watching the UK experiment with huge interest,” Deutsche Bank strategist Jim Reid said in a note to clients.

“It could show a pathway back towards normality or it could be a warning to even heavily vaccinated countries that COVID will be a problem for a decent length of time still.”