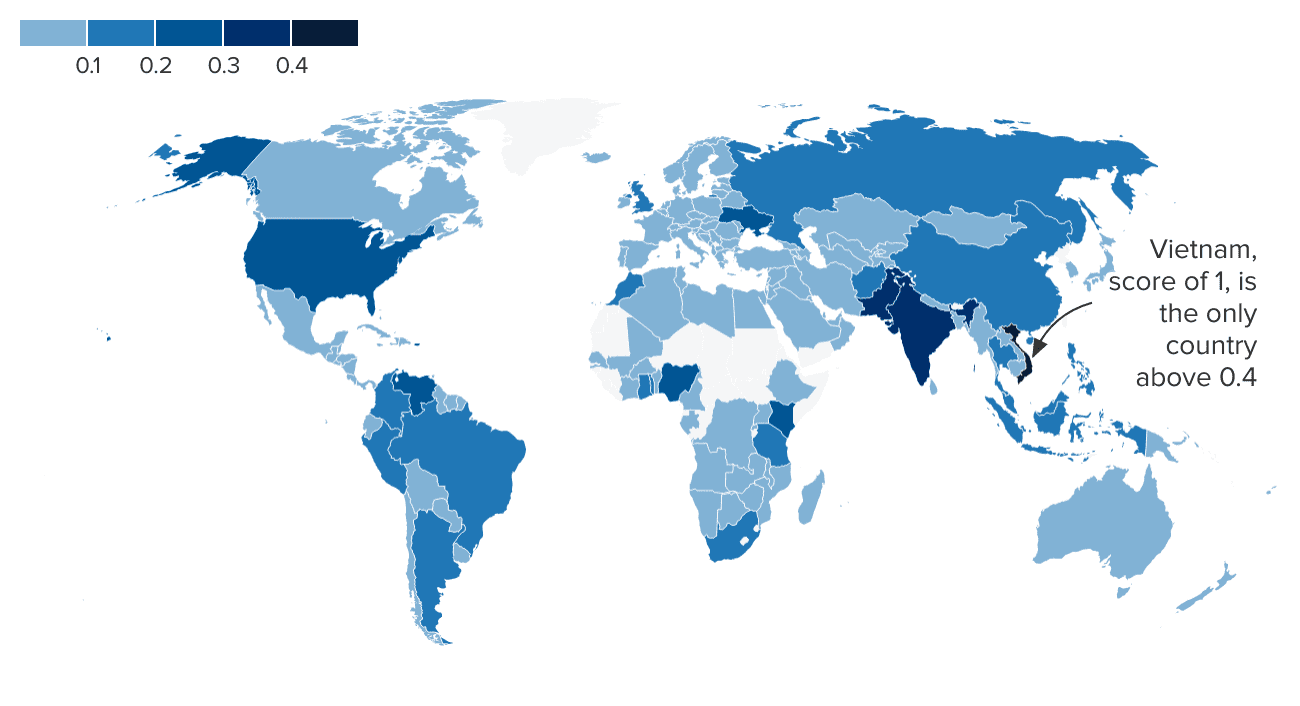

Global adoption of cryptocurrency has taken off in the last year, up 881%, with Vietnam, India and Pakistan firmly in the lead, according to new data from Chainalysis.

It is the second year the blockchain data firm has released its Global Crypto Adoption Index, which ranks 154 countries according to metrics such as peer-to-peer exchange trading volume, rather than gross transaction volume, which typically favors developed nations with high levels of professional and institutional crypto buy-in.

Chainalysis said the purpose of the index is to capture crypto adoption by “ordinary people” and to “focus on use cases related to transactions and individual saving, rather than trading and speculation.” The metrics are weighted to incorporate the wealth of the average person and the value of money generally within particular countries.

Most of the top 20 countries are emerging economies, including Togo, Colombia and Afghanistan.

Meanwhile, the United States slipped from sixth to eighth place, and China, which cracked down on crypto this spring, dropped from fourth to 13th.

Chainalysis ascribes the rising adoption levels in emerging markets to a few key factors.

For one, countries such as Kenya, Nigeria, Vietnam and Venezuela have huge transaction volumes on peer-to-peer, or P2P, platforms when adjusted for purchasing power parity per capita and the internet-using population.

Chainalysis reports that many residents use P2P cryptocurrency exchanges as their primary on-ramp into cryptocurrency, often because they don’t have access to centralized exchanges.

The report also says many residents of these countries turn to cryptocurrency to preserve their savings in the face of currency devaluation, as well as to send and receive remittances and carry out business transactions.

Matt Ahlborg, a peer-to-peer data analyst, told CNBC that Vietnam is one of the top markets for Bitrefill, a company that helps customers live on cryptocurrency by buying gift cards using bitcoin.

“Vietnam stood out to me because it dominated the index,” said Chainalysis’ director of research, Kim Grauer, who compiled the report.

“We heard from experts that people in Vietnam have a history of gambling, and the young, tech-savvy people don’t have much to do with their funds in terms of investing in a traditional ETF, both of which drive crypto adoption,” Grauer said.

Nigeria is a different story, Grauer said. “It has a huge commercial market for crypto. More and more commerce is done on the rails of cryptocurrency, including international trade with counter parties in China.”

These top-ranking nations have another thing in common, according to Boaz Sobrado, a London-based fintech data analyst. “Many have capital controls or a strong emigrant and immigrant population,” he said.

Take Afghanistan, a country currently in turmoil due to the Taliban’s recent overthrow of the government.

“Afghanistan on top makes sense from a capital controls point of view, given it’s hard to move money in and out,” Sobrado said.

The correction for purchasing power parity and gross domestic product may also have boosted its placement, given that Afghanistan is one of the world’s poorest countries.

Analysts note that measuring cryptocurrency adoption at the grassroots level isn’t easy.

“The methodology has a huge blindspot,” Sobrado said. “Unlike many other countries, sanctioned nations don’t have good and clear data on P2P markets.”

Because of that, he said, he believes sanctioned nations such as Cuba will be underestimated, simply because it is harder to track those transactions.

Ahlborg said there is no perfect way to measure per capita global crypto adoption but that this index is “one of the best we have.”