Boris Johnson has announced a major shake-up of social care funding in England.

A hike in National Insurance will pay for a pledge made when Mr Johnson became prime minister in 2019 to “fix the broken care system”.

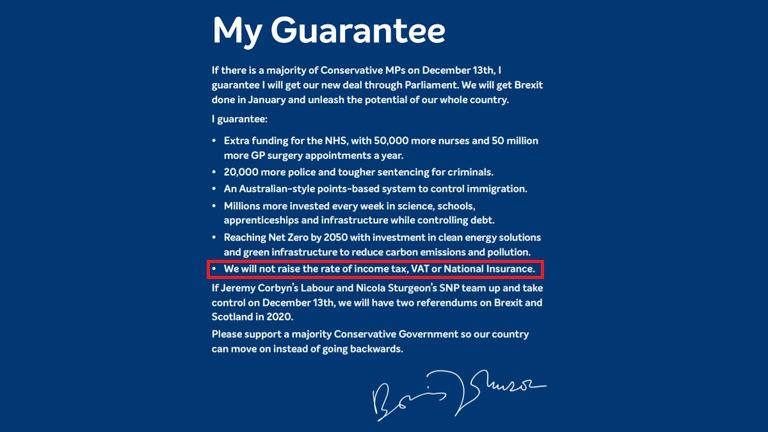

However, this means he will be breaking his promise to not raise taxes, which has angered Tory backbenchers.

Mr Johnson said he was unable to keep that promise due to the COVID pandemic.

What are the changes to social care?

Social care supports the elderly and disabled adults of all ages with non-clinical needs in people’s own homes, residential care homes or in places such as day centres or supported housing.

Unlike the NHS, it has no dedicated funding and is paid for through local authorities.

There is a regular crossover in services and the government has said the new plans will narrow that gap to ensure people receive better quality care.

The reforms will see a threshold of £100,000 on the amount of assets a person has before they have to fully fund their own care. Currently, the threshold is £23,250.

From October 2023, anybody with financial assets lower than £20,000 will not have to pay anything for their care from their assets – but may have to contribute towards costs from their income.

The amount anyone with assets between £20,000 and £100,000 will pay will be means-tested so the fewer financial assets someone has the less they will pay for their care.

The amount anyone has to spend on care will be capped at £86,000 over their lifetime – including younger people receiving care.

They will contribute no more than 20% of their assets each year and if that means the value of their assets falls below £20,000 they will only contribute from their income and not their assets.

At least £500m will be invested over three years to train care workers and provide professional development, fund mental health resources for staff and reform the social recruitment situation. Further detail on that will be published soon.

The government has also promised to support the 5.4m unpaid carers, invest in the disabled facilities grant and supported housing, improve information to help understand options for care users and introduce a support system to ensure local authorities are delivering on their obligations to users.

How will the reforms be paid for?

A health and social care levy will be introduced through National Insurance being increased to 1.25%, which the government says will raise £12 billion per annum over the next three years, ringfenced for the NHS and social care.

Most of that money will initially go to the NHS to fund the backlog in elective procedures caused by the pandemic.

Over the years, more will go towards social care.

The levy will be introduced from April 2022 for everybody who pays National Insurance (people who work and are below pension age).

From April 2023, the levy will appear as a separate line on payslips and pensioners who work will then also have to pay.

Employers will also have to pay an increase of 1.25% in National Insurance tax.

Dividend tax will also increase by 1.25% from April 2022 so people who receive their income through dividends will make the same contribution as those who are employed.

Money raised from the National Insurance rise will go to local authorities who will have to spend it on care.

The changes to social care only apply to England, but because tax changes apply to all four nations, Scotland, Northern Ireland and Wales will also see a rise in National Insurance payments.

Mr Johnson said the devolved nations will together receive an extra £2.2bn a year towards health and social care – 15% more than they would from contributions by their citizens alone.

A total of £1.1bn will go to Scotland in 2024-25, £700m to Wales and £400m on Northern Ireland.

How much will people pay into the health and social care levy?

People earning a base rate of £24,100 will pay £180 more over a year (£3.46 a week).

Those earning £67,100 – the top 14% of earners – will pay £715 more a year (£13.75 a week).

Additional rate taxpayers, which make up 2% of individuals, will contribute nearly 20% of the levy, according to the government.

The government said 70% of the money raised from businesses will come from the largest 1% of businesses, while 40% of businesses – mainly small – will pay nothing extra.

Existing National Insurance relief for employers will apply, with companies employing apprentices under the age of 25, people under the age of 21, veterans and employers in freeports, not having to pay the levy if their yearly gross earnings are less than £50,270, or £25,000 for new freeport employees.

Reactions to the changes

Many Tory backbenchers have vocally opposed the plan to increase National Insurance contributions, saying it is taking from less wealthy, younger workers to fund the elderly.

However, during a Cabinet meeting ahead of Mr Johnson’s social care reform announcement, ministers backed the plan.

Labour leader Sir Keir Starmer has said he will oppose the plans.

He said: “The taxes that pay for social care should be fair across the generations and all forms of income. Those with the broadest shoulders should pay more – not the working families now set for an unfair tax rise.

“We’ve said that this additional investment will need to be funded through tax rises – but increasing National Iinsurance contributions isn’t the right way to do it.

“It would hit working people hard, including low earners and young people, and would place a huge burden on businesses just as they’re trying to get back on their feet.”

Among the Tories unhappy with the plans are former leader Sir Iain Duncan Smith, who called them a “sham” as he said they were not actually reforming the social care system.

Liberal Democrat leader Sir Ed Davey said: “Boris Johnson gave voters a cast iron guarantee that he would not raise National Insurance – and now he’s breaking voters’ trust again.

“Even worse, the government’s plans won’t fix the social care crisis. Our loved ones will still not get the quality care they need.”