UK households have experienced the biggest slump in their financial wellbeing as a surge in the cost of living takes its toll, a new survey suggests.

A quarterly household finance index compiled by Scottish Widows fell to 40.1 in the final quarter of last year, down from 44.0 in the third quarter.

It was the biggest deterioration in the index – where the 50-mark separates improvement from worsening in the household’s financial situation – since the second quarter of 2020.

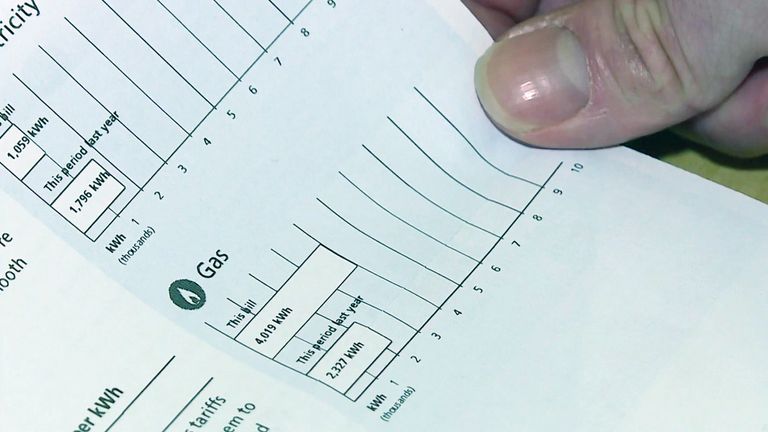

The reading is the latest sign that families are feeling the squeeze from higher prices, with inflation at a ten-year high of 5.1% and expected to climb to 6% by the spring, a level not seen for three decades.

Soaring energy bills and fuel prices as well as higher food costs have been pushing inflation up and households face a further financial headache from rising interest rates – meaning bigger monthly mortgage and loan repayments – and National Insurance hikes.

Findings from the Scottish Widows survey showed the amount of cash consumers had available to spend fell at the sharpest rate for eight years.

Savings also faced a squeeze while there was a slight reduction in income from employment.

The report said only the highest earners added to short-term savings pots while lower earners struggled to put money aside.

Meanwhile there was a renewed increase in demand for unsecured credit, such as overdrafts and credit cards – even as the availability of this declined.

Nearly a quarter of households (23%) said they would have been likely to withdraw money from their pension pot if they could have.

The report found that worries about inflation saw households become increasingly pessimistic about their future finances over the course of 2022.

Their expectations were downgraded “particularly sharply” in December as the new Omicron variant took hold.

The figures were based on a monthly survey of 1,500 people across the UK.

Emma Watkins, managing director of retirement at Scottish Widows said: “It was a challenging end to another year dominated by the coronavirus pandemic for UK households as rising living costs pinched the pockets of people in the fourth quarter.

“With inflation soaring into the new year and cash availability at its lowest since 2014, households’ expectations of future financial wellbeing were the most downbeat since the third quarter of 2020.

“As a result, the strain on current finances has had a knock-on effect to future financial planning.”