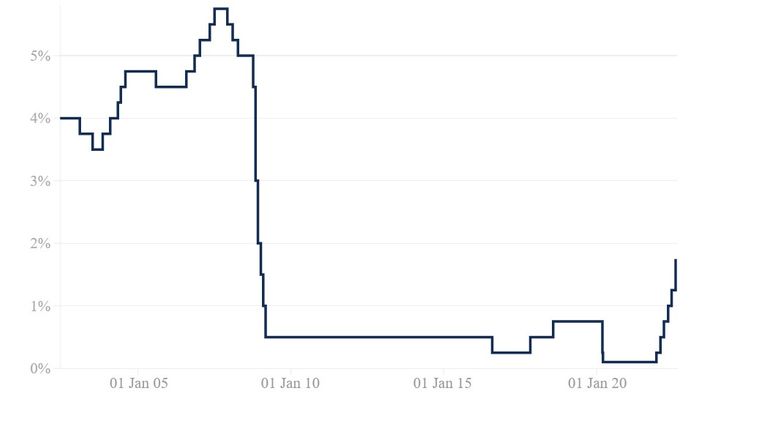

The Bank of England has hiked interest rates by half a percentage point – the sixth rise since December and the biggest rise since 1995.

This means the bank rate now stands at 1.75% – its highest level since late 2008 at the beginning of the global financial crisis.

It will increase borrowing costs for millions of people, including those who have tracker rate mortgages.

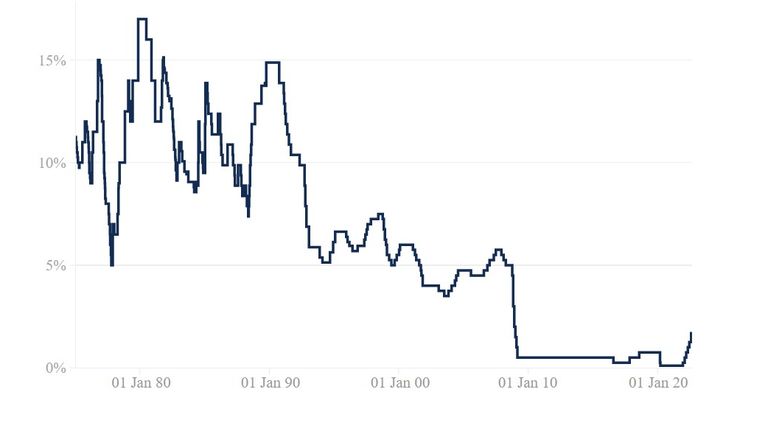

Increasing rates is one of the bank’s main tools to fight inflation, which has soared to 9.4% and could reach 15% early next year, according to this week’s analysis by the Resolution Foundation thinktank.

The bank was under pressure after big hikes by the US Federal Reserve and the European Central Bank.

This article was originally published by Sky.com. Read the original article here.