An advertising agency set up by the brothers who helped propel Margaret Thatcher to power is to orchestrate efforts to persuade millions of Britons to buy shares in NatWest Group, the taxpayer-backed bank.

Sky News has learnt that M&C Saatchi, whose founders in 1995 included Lord Maurice Saatchi and his brother Charles, has been appointed by the Treasury to devise a campaign promoting a retail offer of NatWest shares later this year.

The multimillion pound campaign, which is likely to include a heavy emphasis on social media as well as television and poster ads, is expected to be sanctioned by Jeremy Hunt, the chancellor, after the Budget in March.

Banking sources said on Monday that Barclays had also been drafted in by government officials to work on the retail component of the share sale, which will be one of the most complex undertaken in Britain for years.

Barclays and M&C join Goldman Sachs on the roster of so-called privatisation advisers to the government.

Mr Hunt said in his autumn statement that he wanted to sell part of the government’s remaining stake in NatWest, which was bailed out in 2008 with £45.5bn of taxpayers’ money, through a retail offer.

The shareholding has been steadily reduced in recent years by offering slugs of shares to City institutions and by NatWest buying some of its stock back from the Treasury.

M&C – from which its founders have now departed – will now be charged with evoking the share-owning spirit of the 1980s when Baroness Thatcher ordered the privatisation of a string of state-owned utilities.

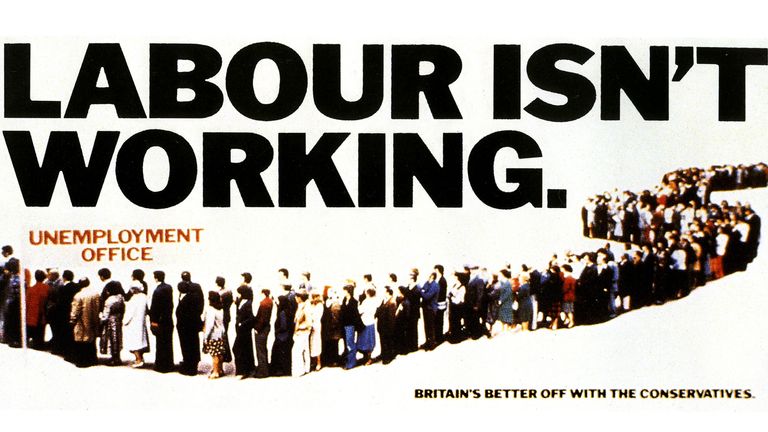

Her triumph in the 1979 general election was partly attributed to the famous ‘Labour isn’t working’ ad campaign in which Saatchi & Saatchi and the late Lord Bell, a public relations executive, played pivotal roles.

Read more from business:

Blackstone in talks to buy data centre construction giant Winthrop

McDonald’s sales dented as war boycotts bite

Campaign for tourist tax U-turn ‘not just about rich shoppers’

The appointment of new advisers on the sell-off comes as NatWest’s board continues the process of picking a permanent new chief executive to lead the bank.

Sky News revealed last week that Heidrick & Struggles has been enlisted by the state-backed bank’s board, weeks before it publishes its annual results.

Heidrick’s appointment was made with the support of Rick Haythornthwaite, NatWest’s chairman-designate, who joined the board earlier this month and takes over from Sir Howard Davies in April.

The search for a permanent successor to Dame Alison Rose, who left last summer amid the furore created by her inaccurate briefing to a BBC journalist about former UKIP leader Nigel Farage’s finances, is expected to reach a swift conclusion, according to shareholders in the bank.

Paul Thwaite, the former head of NatWest’s commercial banking business, has stepped in to replace Dame Alison on an interim basis, and fellow executives regard him as a credible choice to land the job permanently.

Having a long-term boss in place is regarded as being essential to the success of a mass-market sale of NatWest’s shares.

The size of the offering and of the discount that will be given to participating investors are among the details which have yet to be determined.

Treasury officials will be conscious of the need to deliver value-for-money while attempting to persuade Brits to acquire shares they can already buy on the stock market.

The government at one stage owned more than 80% of what was then called Royal Bank of Scotland Group.

It was rescued from outright collapse by an emergency bailout that Fred Goodwin, its then boss, likened to “a drive-by shooting”.

The Treasury and M&C were contacted for comment, while Barclays declined to comment.