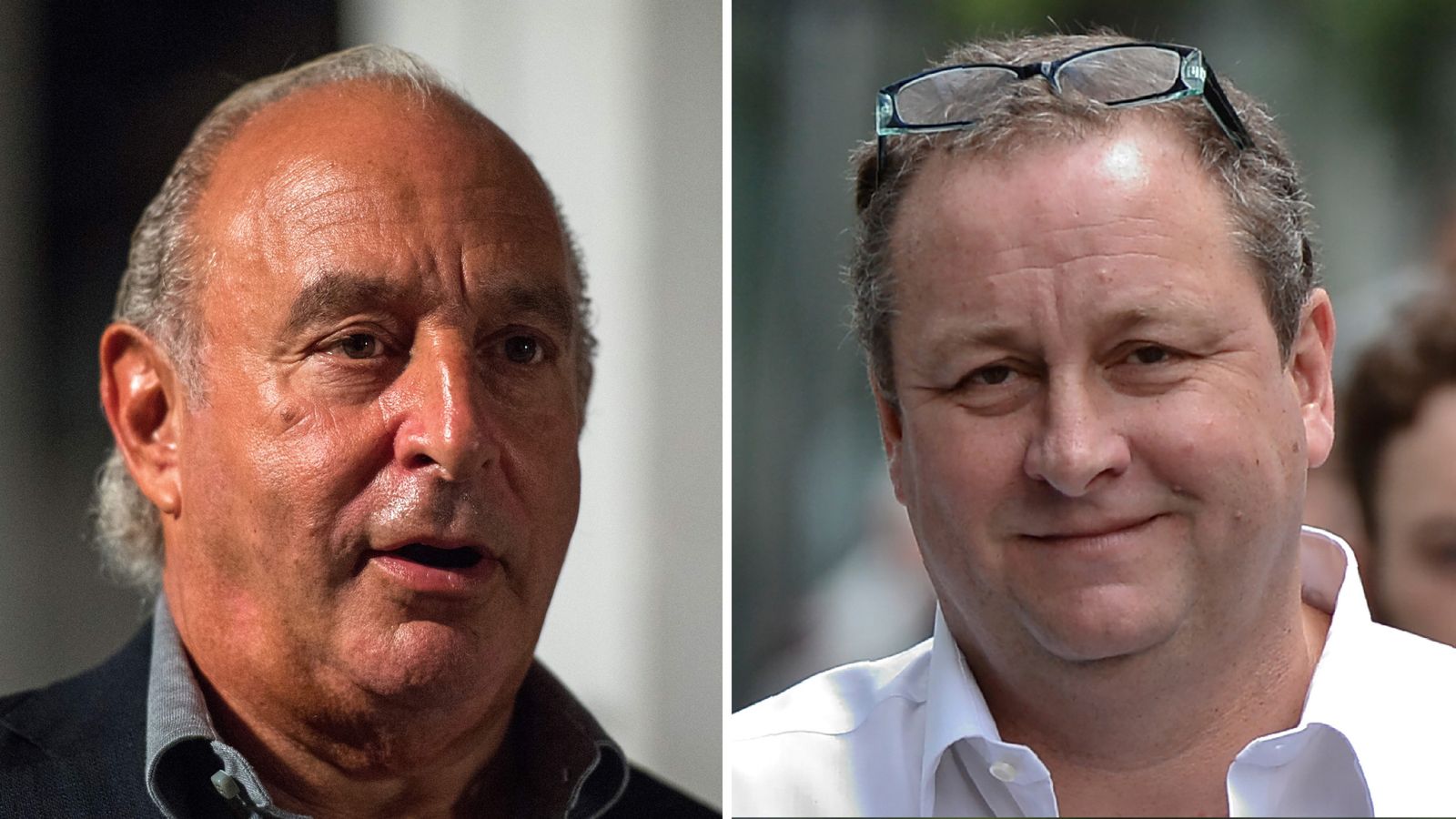

Mike Ashley is offering a £50m lifeline to keep Arcadia Group afloat amid a looming tussle between the high street’s biggest beasts for control of Sir Philip Green’s TopShop empire.

Sky News has learnt that Mr Ashley’s Frasers Group has drawn up plans for an emergency loan to Arcadia just hours before its board appoints administrators, putting 13,000 jobs at risk.

The proposal will intensify the bitter rivalry between the two men, and mirrors similar tactics used by Mr Ashley prior to the collapse of other big retailers, including Debenhams, in recent years.

Chris Wootton, Frasers’ chief financial officer, confirmed the offer on Saturday, saying: ‘We hope that Sir Philip Green and the Arcadia Group will contact us today to discuss how we can support them and help save as many jobs as possible.”

A source close to Frasers said the proposed refinancing was likely to be in the form of a secured loan and was aimed at preventing Arcadia – which also owns Burton and Dorothy Perkins – from falling into administration.

The offer drew scepticism from analysts, however, who pointed out that any loan from Frasers Group or Mr Ashley would require approval from its pension scheme, which would in turn demand additional security over its exposure to the company.

“It sounds like a stunt,” said one.

Mr Ashley told ITV News on Friday that he was interested in buying all of Arcadia’s brands.

Sky News revealed earlier this month that Arcadia had been in talks with a number of parties about an emergency £30m loan, but the issue of security is understood to have played an important role in the inability to finalise a deal.

The collapse of Sir Philip’s retail group, which the billionaire tycoon has owned since 2002, would make it the most prominent casualty since the start of the coronavirus pandemic, joining Debenhams, Edinburgh Woollen Mill and Cath Kidston on the list of high street insolvencies.

This weekend, it also emerged that the taxman was also likely to miss out to the tune of tens of millions of pounds from the administration of Arcadia because of the insolvency’s likely timing.

From Tuesday, the introduction of Crown Preference in insolvencies will mean that Her Majesty’s Revenue and Customs leapfrogs ahead of unsecured creditors and lenders which bankroll firms against their inventory and stock.

If Arcadia appoints administrators on Monday, however, HMRC will rank as an unsecured creditor, meaning it is likely to see only a modest repayment of the tens of millions of pounds it is understood to be owed by Sir Philip’s empire.

That timing is said to be coincidental rather than deliberate, and people close to the situation pointed out that HMRC’s diminished recoveries would result in more money instead being returned to Arcadia’s pension scheme and many small business suppliers to the company.

Arcadia declined to comment beyond a statement it had issued on Friday, in which it said: “The forced closure of our stores for sustained periods as a result of the COVID-19 pandemic has had a material impact on trading across our businesses.

“As a result, the Arcadia boards have been working on a number of contingency options to secure the future of the group’s brands.

“The brands continue to trade and our stores will be opening again in England and ROI as soon as the Government COVID-19 restrictions are lifted next week.”

A further statement is expected on Monday.

Mr Ashley’s professed interest in providing a last-ditch loan to Arcadia comes as he and other high street tycoons position themselves to try to gain control of TopShop and some of Arcadia’s other brands.

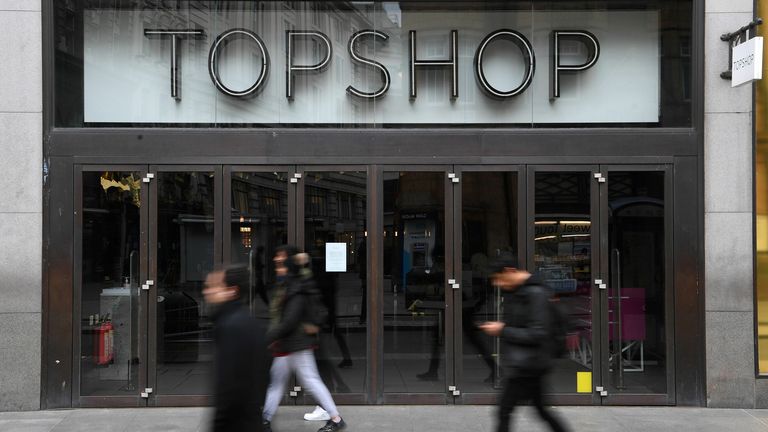

JD Sports Fashion, Boohoo Group and Next are all expected to vie for TopShop, which less than a decade ago was valued at £2bn but which could now command a price of roughly £250m.

Sir Philip is said to be unlikely to seek to buy back any of Arcadia’s trading operations from administrators.

Confirmation of administration would come after a turbulent few years in which Sir Philip’s reputation was destroyed and his fortune diminished by turmoil on the high street and, more recently, the coronavirus pandemic.

Arcadia employs about 13,000 people, having announced about 500 head office job cuts earlier this year.

It has more than 500 standalone sites, the majority of which are closed because of the second England-wide lockdown, which ends next week.

Most of the group’s employees have had their wages subsidised by the taxpayer this year under the government’s furlough scheme.

The company’s collapse would cap one of the most spectacular implosions in recent corporate history.

Sir Philip bought the high street group in 2002 for £850m, and just three years later paid what remains one of the largest-ever dividends – £1.2bn – to Arcadia’s registered owner, Lady Christina.

For years, he was feted as a high street colossus, advising David Cameron on public sector waste during his period as prime minister.

In 2012, he sold a 25% stake in TopShop’s immediate holding company to Leonard Green & Partners, a private equity firm, valuing the fashion chain at £2bn.

Sir Philip was later to buy it back for just $1.

His decision to sell the department store chain BHS in 2015 for £1 to Dominic Chappell, a former bankrupt who was recently jailed for tax evasion, set off a chain of events which cost Sir Philip his reputation and much of his fortune.

BHS collapsed just a year after that deal, sparking a bitter row about Sir Philip’s responsibilities towards its pensioners.

In early 2017, Sir Philip struck a deal with pensions watchdogs to pay more than £360m to the BHS scheme and which set the tone for negotiations over Arcadia’s retirement fund two years later.

Last year, the tycoon narrowly secured approval for a company voluntary arrangement at Arcadia, but was forced to pledge a package of assets worth more than £400m to the company’s pension scheme.

Sir Philip’s miserable period has not been restricted to the performance of his business interests.

He also became embroiled in a storm over his behaviour towards Arcadia employees and his use of non-disclosure agreements to prevent former workers discussing their severance packages.