Asian shares have rallied slightly driven by a US rebound as some analysts said the sanctions imposed by the West against Russia over the invasion of Ukraine were not as strong as markets had feared.

Global share prices plummeted sharply on Thursday after Vladimir Putin unleashed a military assault on the neighbouring country.

While the US, Europe and other countries ramped up efforts to curb the Kremlin’s ability to do business for the attack on Ukraine – freezing bank assets and cutting off state-owned enterprises – they stopped short of ditching Russia from the SWIFT international banking system or targeting its oil and gas exports, which some analysts said had helped markets to recover.

Kyiv hit by ‘horrific rocket strikes’ as Russian invasion enters second day – latest updates

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.57% by midday, Shanghai’s composite index was up 0.57% and Japan’s Nikkei was up 1.27%. South Korea’s benchmark KOSPI index added 1.01%, recovering from a decline.

European stock markets looked set to follow Asia higher even as Russia pressed its attacks and global condemnation grew, with FTSE futures adding 0.78%, European futures up 2.2% and German stock market DAX futures rising 1.56%.

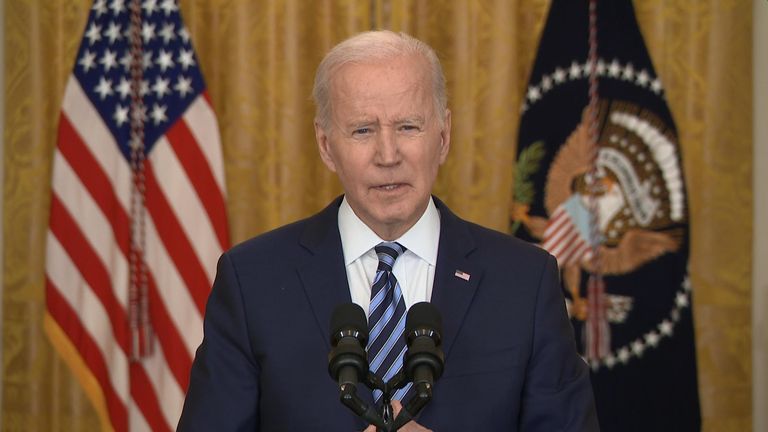

Wall Street indexes had traded in the red, but later recovered after the US President Joe Biden unveiled fresh sanctions.

The Dow Jones closed up 0.28%, while the S&P 500 gained 1.5% and the Nasdaq added 3.34%.

In London, the FTSE 100 closed 3.9% lower – wiping £77bn off the value of its constituent companies and the biggest percentage drop since June 2020 – while France’s CAC index and Germany’s DAX were also each off by nearly 4%.

Jeffrey Halley, senior market analyst at OANDA, said in a note: “The limits to the economic pain that the ‘West’ was prepared to tolerate to support Ukraine and punish Russia have been revealed within 24 hours of Russia’s offensive beginning.

Friday’s papers lead with ‘darkest day in peacetime history’

“The Russian offensive has occurred in a time of already high inflation and commodity shortages globally, and the West has blinked immediately. The process of throwing Ukraine under the geopolitical bus has begun.

“Markets clearly felt the same way, that this is the worst it can get.”

But some analysts worry any rallies might be fleeting.

Subscribe to the Daily podcast on Apple Podcasts, Google Podcasts, Spotify and Spreaker

Kyle Rodda, analyst at IG Markets in Melbourne, said: “Biden’s sanctions and reluctance to pour troops in is providing some relief. But this conflict is going to be a protracted issue and add to global inflationary pressures that will keep central banks on track for tightening.

“It’s okay for now, but in the long-term the market will be tracking to the downside.”

Oil prices had surged again on worries about supply disruptions caused by the crisis, with Brent crude rising 2% to $101.80 a barrel, but later settled back to $99.08.