Cisco shares were down as much as 13% in extended trading on Wednesday after the networking hardware maker issued a glum forecast for the current quarter and the full fiscal year.

Here’s how the company did, compared to the consensus among analysts surveyed by LSEG, formerly known as Refinitiv:

- Earnings: $1.11 per share, adjusted, vs. $1.03 per share expected

- Revenue: $14.67 billion vs. $14.61 billion expected

Revenue increased by 7.6% in the fiscal first quarter, which ended on Oct. 28, according to a statement. Net income, at $3.64 billion, or 89 cents per share, rose from $2.67 billion, or 65 cents per share, in the year-ago quarter.

During the quarter, new product orders slowed down, mainly because clients are busy installing and implementing products after strong delivery in the three previous quarter, Cisco said in the statement.

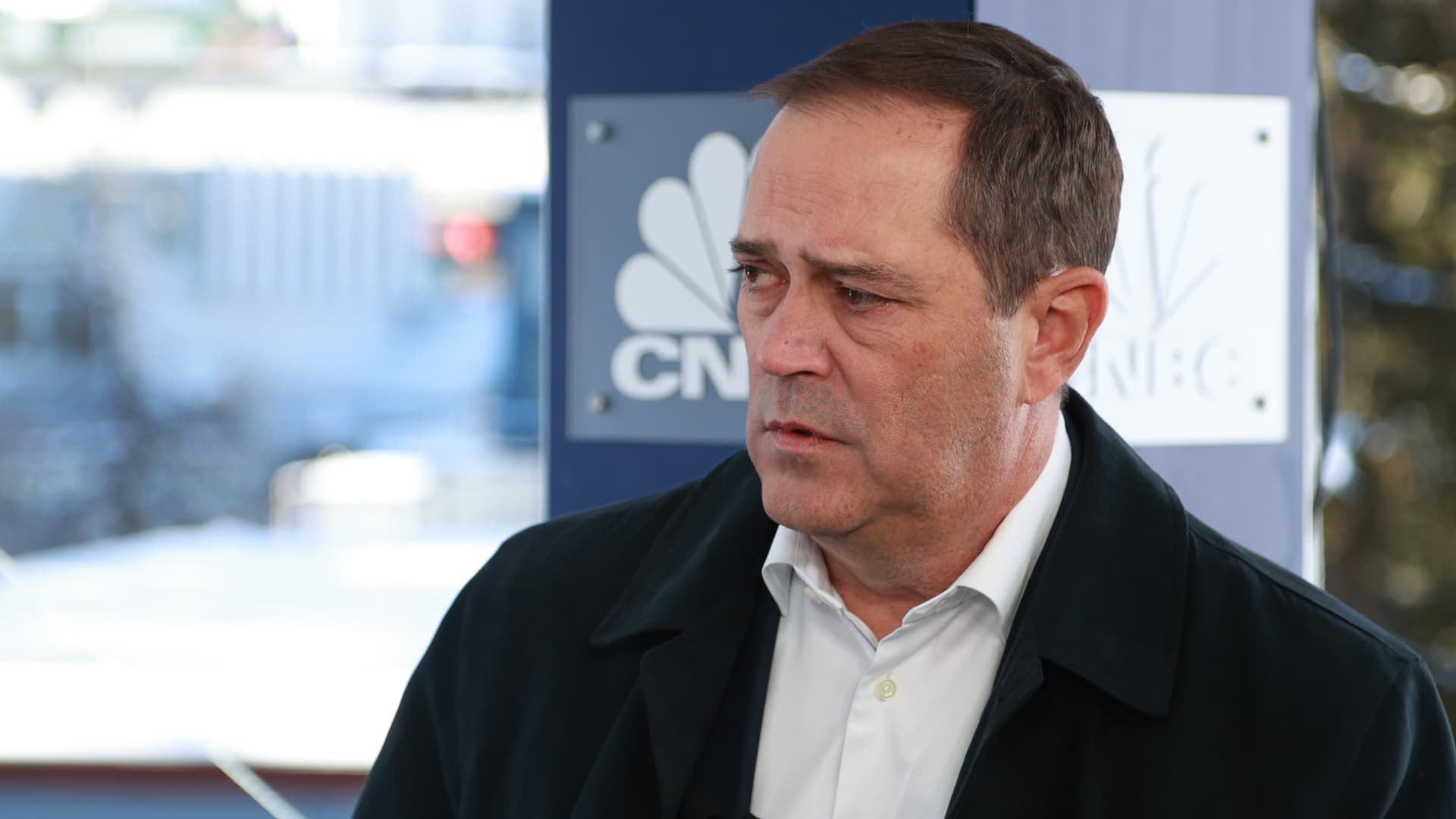

“Our customers and our sales organizations have been very clear with us over the last 90 days that this is the issue,” Cisco CEO Chuck Robbins said on a conference call with analysts. But he said sales cycles remain longer than usual.

The company is projecting that one or two quarters of shipped products are waiting to be implemented.

With respect to guidance, Cisco called for 82 cents to 84 cents in adjusted earnings per share on $12.6 billion to $12.8 billion in the fiscal second quarter. That implies a 6.6% revenue decline. Analysts polled by LSEG had expected 99 cents in adjusted earnings per share on $14.19 billion.

Cisco reduced its full-year forecast for revenue but bumped up its view for earnings. The company now sees $3.87 to $3.93 in adjusted earnings per share on $53.8 billion to $55.0 billion in revenue. In August, it was looking for $3.19 to $3.32 in adjusted earnings per share and $57.0 billion to $58.2 billion in revenue. Analysts surveyed by Refinitiv had expected $4.05 in adjusted earnings per share and revenue of $57.76 billion.

During the quarter Cisco announced plans to acquire data analytics software maker Splunk for $28 billion.

Executives will discuss the results with analysts on a conference call starting at 4:30 p.m. ET.

Notwithstanding the after-hours move, Cisco share have climbed 12% so far this year, trailing the S&P 500 index, which is up 17% over the same period.